After setting your targeting and designing your creative, have you ever wondered if your ads are truly reaching the right audience, beyond what the platforms are telling you?

In our day-to-day work as advertising professionals, we aim to be as consistent as possible, implementing best practices and following platform guidelines to deliver quality ads at scale for our clients. This is a detailed process that captures tons of data along the way, and our unique process allows us to identify trends and modify our practices to ensure quality and consistency over time. However, some trends take a bit longer to develop, and might be a little harder to avoid without the right data.

From 2021 to 2024, the ChatterBlast team embarked on a journey to uncover the secrets behind Meta’s ad distribution system in a post-App Tracking Transparency world. Sure, we were achieving results, and yes, we were seeing return on ad spend that has helped businesses thrive, but in our quest to optimize, we wanted to find out where our ads were going, who they were reaching, and how effective they really were. Meta heavily pushes automation in their ad campaign builder, especially using dark patterns designed to trick you into implementing what they want, so we worked with some, ditched others, and logged our results to find definitive trends that could inform better processes.

For this study, we focused specifically on the website traffic objective, looked at Meta’s automated ad placements across Facebook, Instagram, Audience Network, and Messenger (keeping most ad placements across platforms for each ad set), then evaluated across age groups (ads targeting users 18-65+) and genders (selecting “all”) to see if we can trust the algorithm overlords with targeting. In terms of volume, this study looked at over 16.5M impressions across 243 campaigns that met specific criteria. It’s also important to note that Meta released LLaMA (Large Language Model Meta AI), the engine that runs all of their internal and external AI services, in February of 2023.

Our Test Period Results: 2021–2023

Red Flag #1: The Facebook Fallacy

Right off the bat, we saw some alarming trends in our platform data. Facebook emerged as the dominant platform for our ads, with 72.2% of impressions, 87.2% of clicks, and 87% of engagements in 2021. But by 2023, those numbers had ballooned to 90.4% of impressions, 93.7% of clicks, and 92.2% of engagements. Meanwhile, Instagram was fading into the background, dropping from 26.7% of impressions in 2021 to just 9.2% in 2023. This skewed distribution raised a red flag. Why was Meta’s automated system so heavily favoring Facebook?

Our analysis revealed the system was optimizing for cost-effectiveness—Facebook offered lower CPC (cost per click) and CPM (cost per thousand impressions) compared to Instagram, and the platform was pushing almost all performance towards Facebook in response. In theory, this is exactly how the system should work, but in practice, quality business results may not always arrive from the cheapest platform.

Red Flag #2: Aged Like Not-So-Fine Wine

As we explored deeper, we noticed older age groups (55-64 and 65+) consistently received the lion’s share of impressions, clicks, and engagements, while younger audiences were being left behind. While this trend changed a bit in 2023 (age groups 35-44 and 45-54 received more volume at this point), there was never a consistent balance to age groups, or any predictable way to deliver to a broad audience, especially those in the 18-24 demo who are likely affected both by these age restrictions as well as the platform restrictions, given Facebook’s cringe-factor as the place where their parents hang out.

Red Flag #3: Gender Binaries Are Always Bad

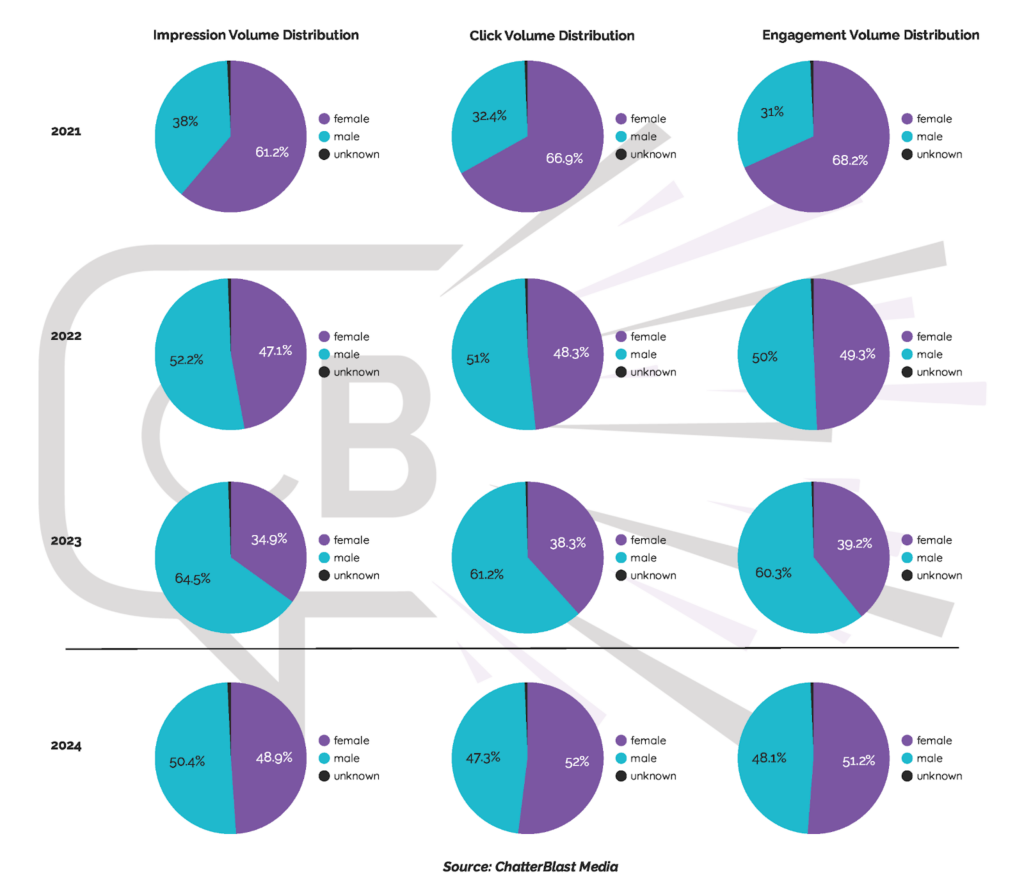

When looking at performance across available gender profiles (male, female, and unknown), there was additional volatility. 2022 was the best year for automated balance, but theoretically, balance should almost always be achieved, given many broad areas have fairly balanced demographics when it comes to gender. In 2021 (women) and 2023 (men), automation skewed delivery heavily in one direction, which again forced impressions in front of audiences that may not have driven optimal business results.

No, there’s no grand conspiracy here at play with Meta. The long and short of it comes down to their machine learning algorithms and the data that powers them. Before 2021, there was plenty of data piping through from browsers, operating systems, networks, and external data that informed signals like gender, age, and interests to help push ads more equitably in front of consumers. After 2021, Apple and other data providers pulled the plug on that info, forcing Meta, Google, and other advertisers to scramble to find signals that could allude to this information. Meta has the upper hand in this, since most people sign up and provide real life data on who they are in their profiles (since Aunt Marie and your cousins want to make sure they’re connecting with a real family member).

While these signals should be a starting point for campaigns to work from, they should by no means deliver in very constrained ways over time. Ads shouldn’t be shoehorned into Facebook from the jump, especially if the audience is set to deliver broadly across all ages, and it’s a known fact that younger audiences engage more on Instagram. Men might not click on articles to read blog content more than women, but that doesn’t mean that all website traffic ads—blogs or products alike—should be skewed to only deliver to women, or men, at scale.

After digesting all of this, we decided to take action decisively in 2024, and publish the results (hello!) to help everyone understand that trends can be reversed with manual intervention.

What We Did in 2024 (And How You Can Too)

The only true way to get evenly split performance is to evenly split your ad sets based on what you plan to achieve. For this test, we wanted to see a healthy balance across all ages, gender performance, and overall in the distribution of platform volume. In the charts above, you can see how removing Audience Network and Messenger (consistently low performers across all years) and splitting dollars across Facebook and Instagram helped drive more impressions and results over to Instagram (which ultimately didn’t affect CPM or CPC), as well as balance out age and gender performance. Facebook oddly got cheaper as a result of our intervention, and while our click-through rates took a little bit of a hit, business outcomes for clients improved significantly.

Our long-term study exposed a critical flaw in Meta’s automated ad distribution, especially after they implemented their new LLM to “improve” results. Meta prioritizes immediate results over balanced reach, and while they claim it’s in the name of improving efficiency, the truth is that manually splitting your audiences to create actual balance won’t greatly impact your results, and can even improve business results over time.

Ad delivery on Facebook and Instagram has slowly cost more and more over time as many businesses flock to reach cheap eyeballs, but you don’t have to resign to having your audience diminish as a result. Having full control over when, where, and how your ads are delivering will always allow you to fix problems and avert data trends to make sure you’re maximizing those hard earned ad dollars.