Benchmarks are a crucial indicator of the future success of a company or brand. They focus on determining the best performance in order to set a standard for future practices.

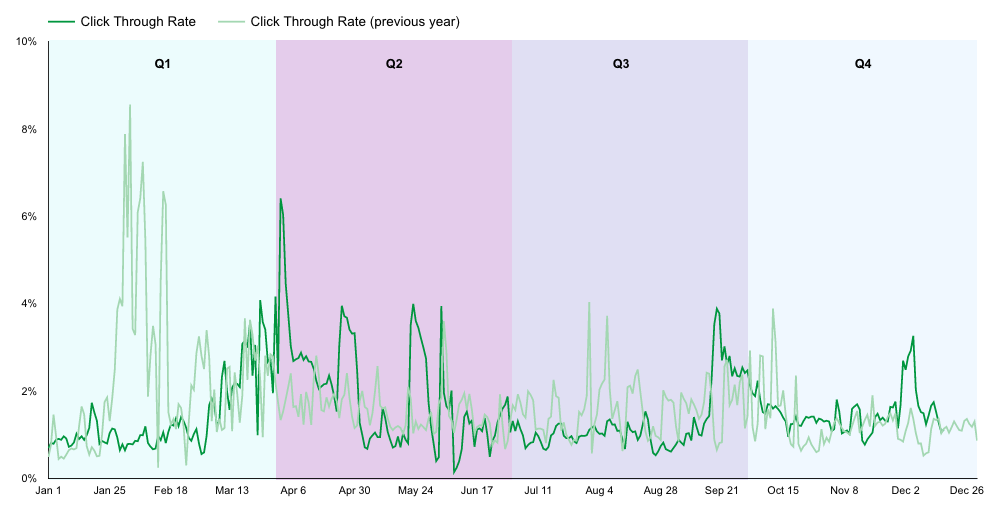

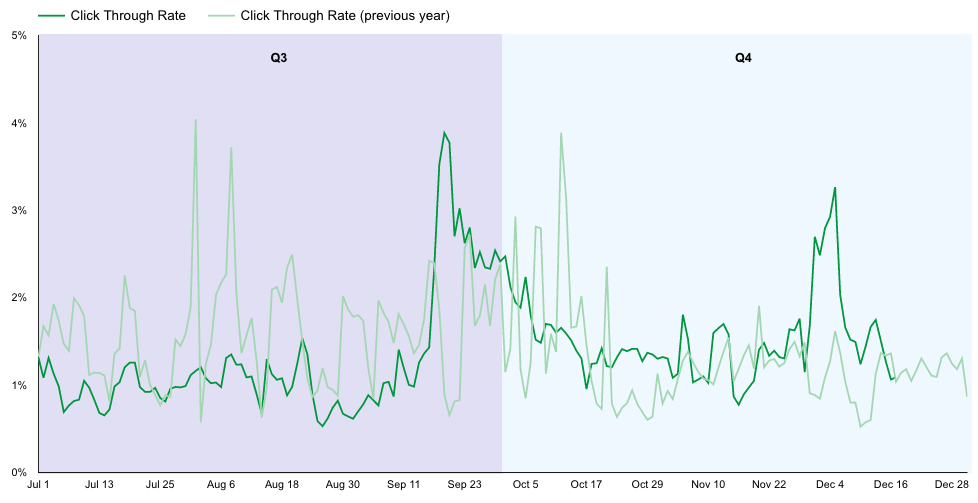

In 2019, performance was average, with click-through rates (CTR) not exceeding 1.44%. In 2020 however, our lowest quarter CTR surpassed the previous year’s highest. This is important to note because it shows how benchmarks help companies learn from previous performance in order to improve their success moving forward.

For this report, we looked at all campaigns and accounts handled by ChatterBlast in 2019 and 2020, focusing on website traffic, conversion campaigns, and cost per mille (CPM) for those campaigns. The main KPI we looked at is outbound click-through rate, to ensure parity across all accounts regardless of the project’s final goal.

Let’s take a look at how 2020 panned out compared to 2019—and how COVID-19 impacted everything.

Getting started

Consider these key insights before we dive deeper.

Q2 was the best-performing quarter in 2020, in terms of CTR.

Q2 had a CTR of 2.10%, which is the highest among all quarters in 2020. Q2 2020 is the best indicator of how things changed with COVID-19 in terms of media, since it contained the beginning of the pandemic. Because stay-at-home orders first took effect during this time, consumers were spending more time on their devices than ever before, which could be the reason for the spike in CTR compared to the previous quarter, as well as the following quarters.

Q2 2020 outperformed Q2 2019 from both a performance and efficiency standpoint.

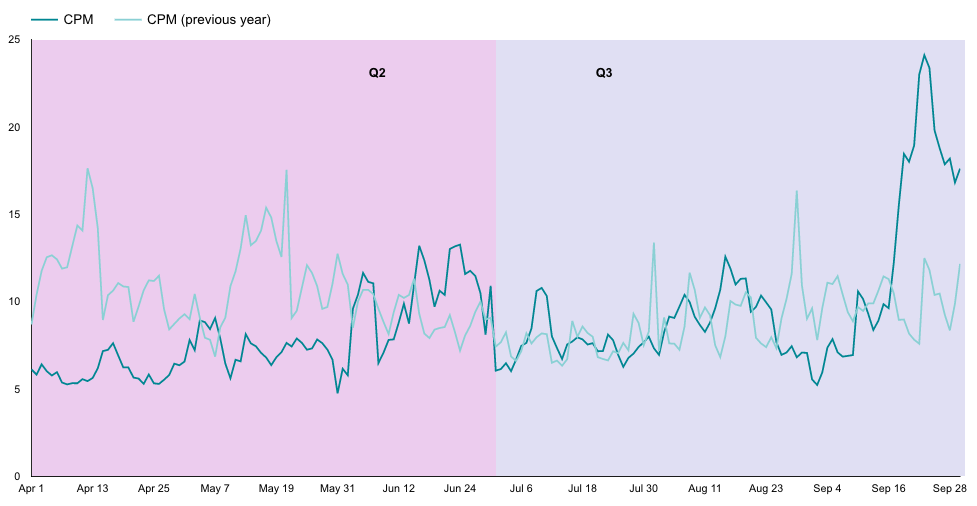

CTR increased by 56.72% year-over-year, while CPM decreased by 31.07%. This is likely attributed to consumers spending more time on social media due to stay-at-home orders taking effect at the start of April, as COVID-19 cases began to rise.

Prior to COVID, Q1 of 2020 performed better in both performance and cost than Q1 2019.

CTR increased by 4.32% and CPM decreased by 29.15% year-over-year. This could be a result of significantly low impression volume in February of 2019 and extreme spikes in impressions in March of 2020. We see a very inconsistent trend in impressions in Q1 2019, with a steadier trend emerging in Q1 2020.

COVID-19’s impact on industries

Looking back on the pre-pandemic world, Q1 and Q2 of 2019 performed relatively well. Spending more than doubled in Q2 compared to Q1, and Q2 of 2019 gained 37.72% more clicks, while taking a bit of a hit when it comes to cost. CPM increased 71.83% compared to the previous quarter, which is likely attributed to the massive increase in budget spent.

Year-over-year, spending increased significantly. This is likely attributed to an increase in client budget as they expanded their digital media presence in light of COVID-19. Throughout 2020, spending increased over each quarter. Although Q2 2020 gained a higher CTR than the previous quarter by 44.83%, CPM also increased by 67.2%, which is not ideal, but is likely inevitable given the increase in amount spent quarter-over-quarter. Depending on campaign goals, either quarter could be deemed successful in its own regard.

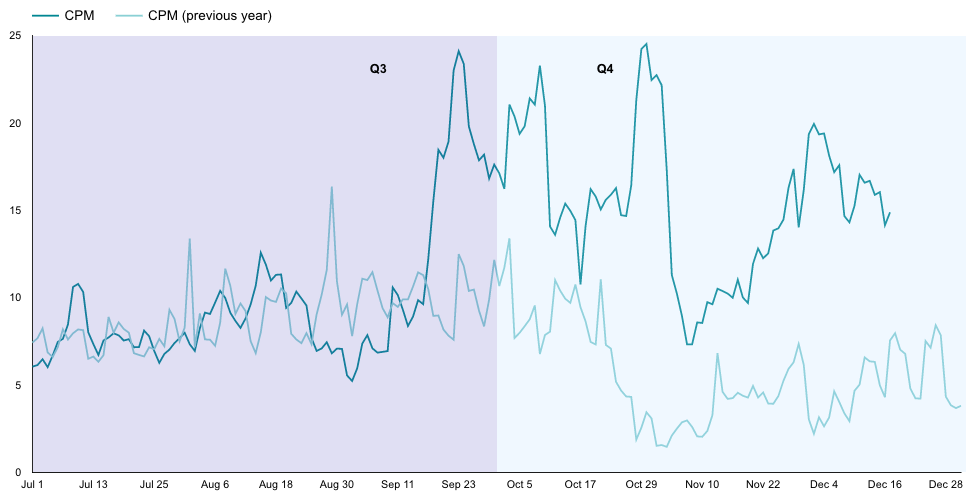

Q3 2020 performed better than Q3 2019, with a 21.53% increase in CTR. Outbound clicks rose significantly, increasing by 189.9% quarter over quarter. CPM rose by 55.94%, which is to be expected due to the massive increase in spending. Aside from Q3 alone, CPM predictably increased in the second half of 2020, given the larger budget.

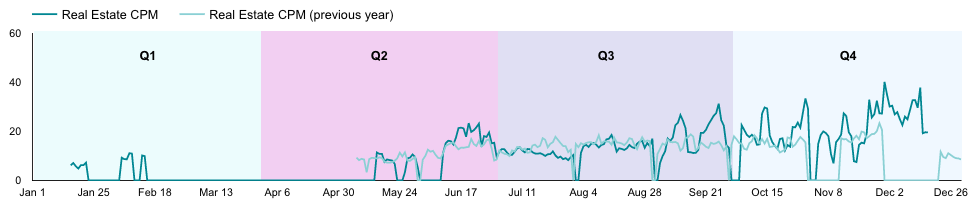

Moving on to COVID19’s impact on specific industries, let’s dive into real estate. From a real estate standpoint, 2019 performed better in both efficiency and performance YOY. This is attributed to the real estate industry being heavily impacted by COVID-19. Some real estate brands completely shut off their ads for a certain period of time in Q1 and Q2 when COVID-19 first became a concern. Shutting off real estate ads seemed to be a good move for the industry, as many consumers were focused more on their health above anything else.

Aside from health concerns, the unemployment rate began increasing at an alarming rate, which made people less likely to be in the market of purchasing a home. Once real estate ads picked back up again, they did not perform as well as the previous year. Q4 of 2020 had a lower CTR and higher CPM year-over-year. This is to be expected during these unprecedented times, especially following a pause in promotion.

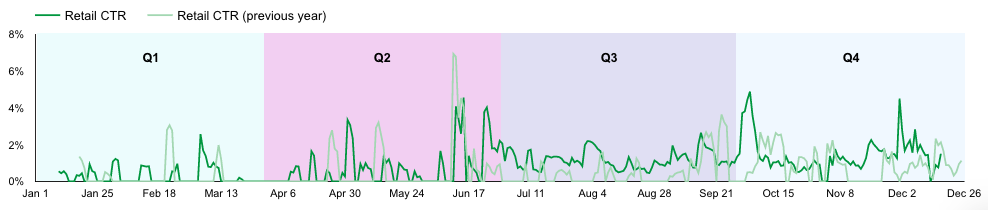

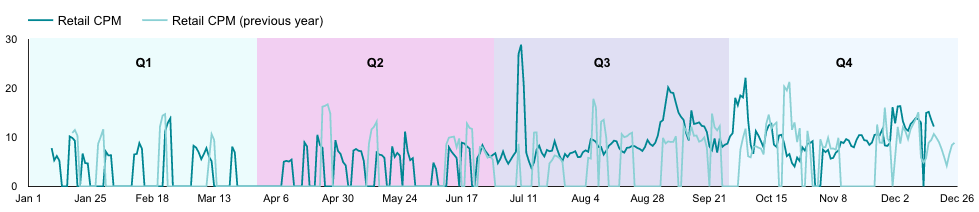

When it comes to retail, ads were not affected too much year-over-year. CTR in 2020 seems to be consistent with the previous year, seeing some spikes in Q4. CPM seems to follow the same trend, with a bit of a higher CPM in Q3 and Q4. Both of these spikes are likely a result of the holiday promotion, with online gift purchasing at its peak.

The 2020 election

Since 2020 was an election year, inventory expectedly became more expensive as competition rose, which could have led to the significant increase in CPM that we see across Q3 and Q4. While Q3 2020 and Q4 2020 CTR increased YOY by 21.53% and 32.14% respectively, campaign efficiency suffered slightly due to increased budget. CPM rose by 55.94% in Q3 2020 and by 230.78% in Q4 2020. Higher CPM in the second half of the year is predictable as many brands fight for Facebook ad spots for the holiday season. CPM is most likely expected to be lower in the first half of the year than in the second half for this reason.

Comparing Q2 2020 to Q3 2020, we see a spike in CPM and clicks but a slight decrease in CTR. Outbound clicks increased by 23.28%, and CPM also increased by 56.12%. CTR expectedly decreased by 16.66% quarter-over-quarter due to significant increase in budget and impression volume.

Despite a spike in CTR in Q1 2019, 2020 CTR seemed to remain relatively consistent with the previous year. With regard to political and advocacy-related clients, we see a high CTR in the first half of the year, with a slight decrease in the beginning of Q3, before picking back up again mid Q3 and Q4. We see relatively the same trend when it comes to CPM, but with a significantly higher spike in Q3 and Q4 YOY, before political ads ended in early November. We attribute this the 2020 presidential election and the rising competition for Facebook ad inventory dominating the second half of the year.

Notable events

COVID-19 has heavily impacted every ounce of normalcy we once knew. Every aspect of daily life has been affected for both consumers and brands, advertising being one of them. On March 16, 2020, Pennsylvania went into a state-wide lockdown, forcing people into the confines of their own homes. It is interesting to note that we see a massive spike in impressions right around this timeframe, as well as an increased number of outbound clicks compared to the previous quarter.

Across all brands, we see a spike in CTR right towards the end of Q1 towards the beginning of Q2, which is reflective of the COVID guidelines that were put into place at this exact time. With regard to CPM, it did not change much after COVID news broke; however, it did seem to decrease YOY, despite a few spikes towards the end of the year, which is to be expected.

Takeaways

It is hard to find any certainty throughout these unprecedented times, but one thing that is certain is that ads performed significantly better in 2020 than 2019. Focusing on 2020 alone, the first half of the year seemed to perform better in both efficiency and performance, compared to the second half of the year. The best quarter with regard to performance was Q2, while the best quarter for cost was Q1. The second half of 2020 performed well, but at a higher cost. CPM increased with each quarter in 2020, which is not surprising considering digital media has become a very prevalent and essential part of the socially-distanced world.

Although 2020 has robbed us of normalcy, there is hope that 2021 will be a better, healthier year, in more ways than one. With a vaccine already in the works and essential workers having the option to receive the it by the end of this year, 2021 seems hopeful for both consumers and businesses.

That being said, I believe that digital advertising will still hold a very heavy presence in the industry, as people have become reliant on media for all their needs this past year. For brands, it’s important to maintain a strong media presence when it comes to advertising, as the pandemic has helped digital marketing and will most likely continue to help it, even in a post-pandemic world.